Senior Talent Trends in the Baltics: Why Leadership Roles Stay Vacant

Senior talent trends in the Baltics reveal a growing mismatch between hiring demand and available expertise.

While overall vacancy volumes are cooling across Estonia, Latvia, and Lithuania, senior specialists, expert roles, and leadership positions remain structurally hard to fill.

The market is not easier.

It is more selective, more constrained, and more unforgiving.

What looks like “less hiring” in 2025 is, in reality, a shift toward mission-critical roles. Roles that sit at the intersection of strategy, execution, and deep expertise. And those roles are staying open longer than ever.

Across Estonia, Latvia, and Lithuania, three patterns dominate:

- Leadership and senior specialist roles remain the hardest to fill, despite lower overall vacancy volumes

- Demand has shifted away from generalist profiles toward narrow, high-impact expertise

- Wage pressure is rising faster than productivity, creating a growing competitiveness risk especially for employers relying only on local talent pools.

The highest-demand leadership role across the Baltics

In 2024, Sales, Marketing, and Development Managers recorded the highest job vacancy rate of any professional occupation group: 8.4%.

This figure:

- Comes from online job advertisement data

- Refers specifically to leadership-level roles, not frontline sales positions

Despite economic uncertainty and reduced hiring volumes, this demand persisted into 2025.

It shows a clear structural bottleneck.

The implication is blunt:

Companies need leaders who can execute growth strategies but cannot find enough experienced ones.

This is not a branding issue.

It is not an employer-value-proposition problem.

It is a scarcity of execution-ready leadership.

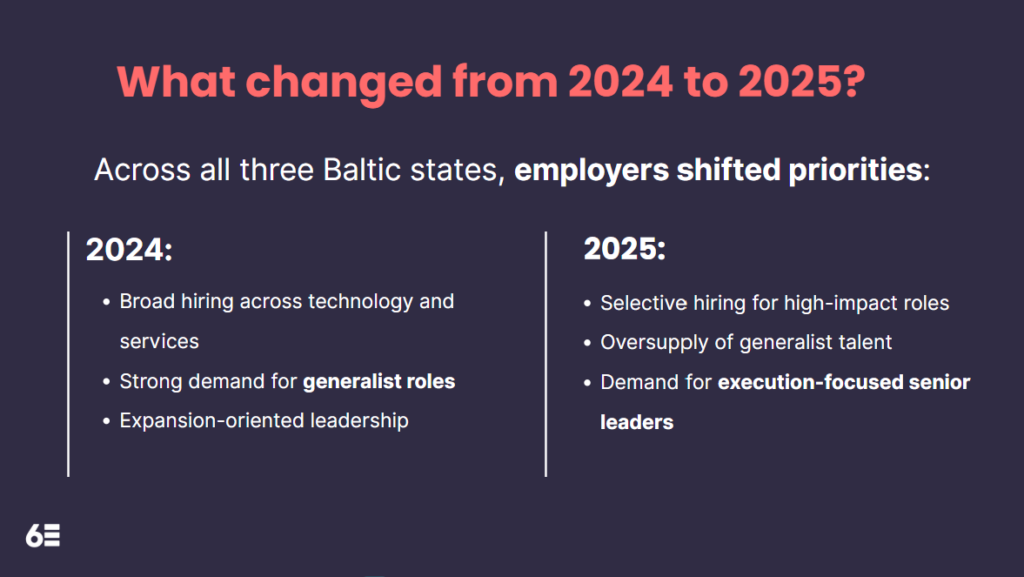

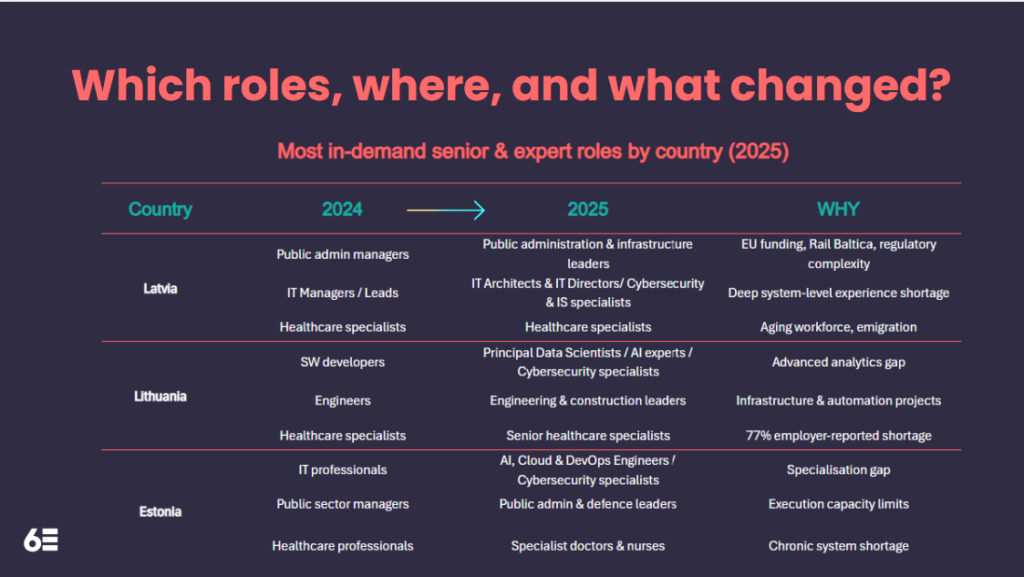

Senior talent trends in the Baltics: what changed from 2024 to 2025?

Across all three Baltic states, employers shifted priorities.

This shift explains why many TA teams feel the tension so acutely: fewer roles to hire for, but far harder to close.

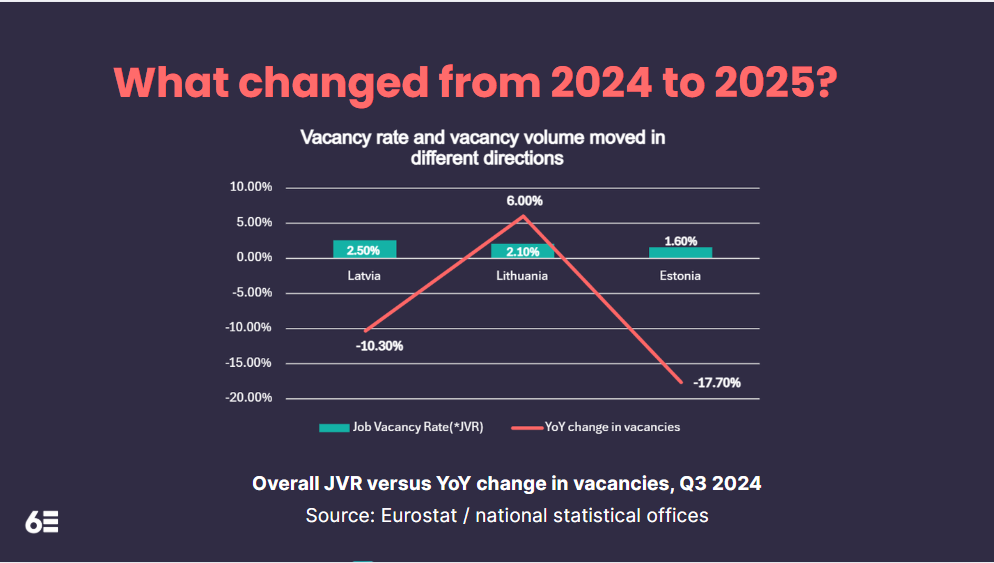

Senior Talent Trends in the Baltics (2024–2025): What Hiring Data Really Shows

- Latvia: highest overall JVR despite a decline in total vacancies

- Estonia: sharp vacancy contraction driven by labour-cost pressure

- Lithuania: vacancy growth masking replacement-driven demand

To understand what’s really happening, it’s essential to separate volume from difficulty.

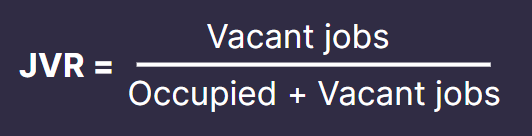

Although JVR is an aggregate measure, it becomes strategically relevant when:

- Total vacancies decline year-on-year

- But the vacancy rate remains elevated

- And vacancies concentrate in specific sectors or professional groups

This combination indicates structural hiring difficulty, typically affecting senior, specialised, and leadership positions, which stay open longer because suitable talent is scarce.

At first glance, Estonia and Latvia look like “cooling markets”. But this is misleading.

The roles that disappeared were mostly non-critical or generalist.

The roles that remain open are senior, specialised, and leadership-heavy, staying vacant longer because suitable candidates simply do not exist in sufficient numbers locally.

Latvia illustrates this best: despite fewer vacancies overall, it still records the highest vacancy rate, signaling structural mismatch, not cyclical slowdown. Non-critical and generalist hiring slowed, while senior and expert vacancies persist longer.

Technology roles: fewer hires, higher expectations

The tech labour market shows the same pattern just more sharply.

What the data shows

- Oversupply of frontend and generalist developers

- Persistent shortages in:

- AI Engineers

- Cybersecurity Specialists

- Cloud & DevOps Engineers

- IT Architects

- IT Directors and senior tech managers

The problem is not coding capacity.

It is a shortage of system-level thinking, security & risk leadership, and architectural experience. Of people who can scale, stabilize, and defend complex environments.

Cybersecurity deserves special mention: it is consistently cited as a critical shortage, but often embedded inside broader ICT categories in national statistics. The demand is real and acute, even when it doesn’t always surface as a standalone job title.

Most in-demand senior roles by country (2024 vs 2025)

Estonia faces an estimated annual shortfall of ~1,400 top-level specialists.

Why senior talent scarcity is structural, not cyclical

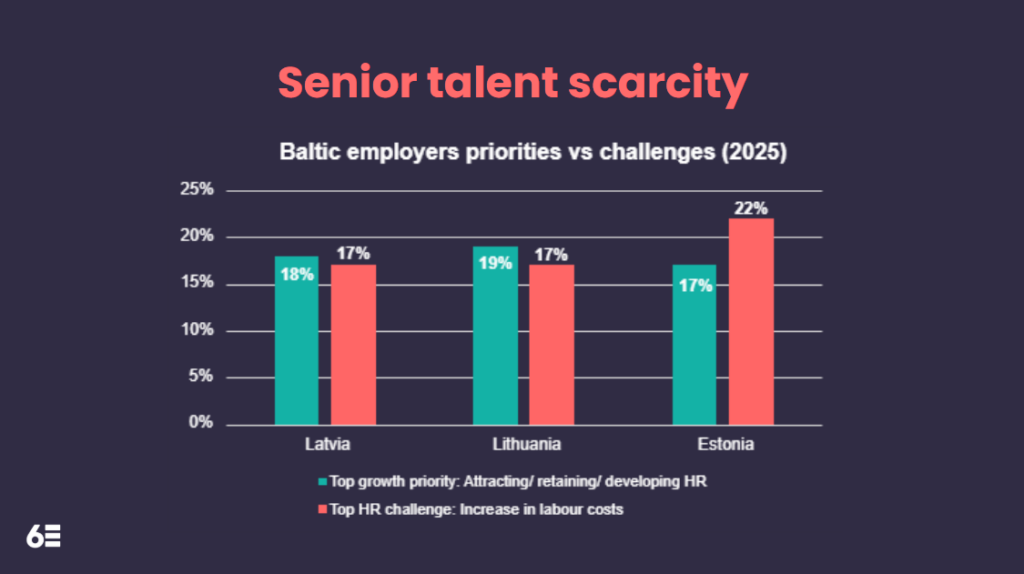

Employers across the Baltics agree on two things:

- Attracting, retaining, and developing talent is the top growth priority

- Rising labour costs and talent shortages are the main constraints blocking execution

These pressures reinforce each other through three structural forces.

1. Replacement demand dominates growth

According to Cedefop Skills Forecast, in Lithuania, 30.4% of all job openings through 2035 will be professional roles, mainly due to retirement and exits, not expansion.

2. Specialisation beats availability

General skills exist. Lived experience in complex environments does not (AI, cybersecurity, large-scale programmes).

3. Leadership effectiveness gap

According to PwC’s Human Capital & Work Environment Survey 2025, employers rank “effective management and leadership” as a top growth priority, while simultaneously reporting difficulty finding leaders who can deliver under cost pressure.

Rising labour costs make the problem worse

In the same 2025 PwC survey, 22% of Estonian employers cite labour cost growth as their top HR challenge; Latvia and Lithuania follow at 17% each.

This creates a reinforcing risk loop:

scarcity → wage inflation → weaker competitiveness → slower growth → even fewer experienced leaders willing to join.

The real 2025 hiring reality in the Baltics

The Baltic labour market is not running out of people.

It is running out of:

- Senior specialists with depth

- Leaders with execution capability

- Experts who can operate under complexity

Fewer roles are open.

The wrong ones are easy to fill.

The right ones stay vacant.

This is no longer a recruitment problem.

It is a leadership capacity problem and one that will define competitiveness across the region in the years ahead.

This analysis builds on our ongoing research into hiring dynamics and leadership capacity in the Baltics, which we explore further in our work on recruitment strategy and senior hiring advisor.

Recommended data sources to explore:

- Eurostat – Job Vacancy Statistics

- PwC Baltic Human Capital Survey

- Cedefop Skills Forecast