The Hidden Cost of Open Roles: How Long Vacancies Impact Business Performance

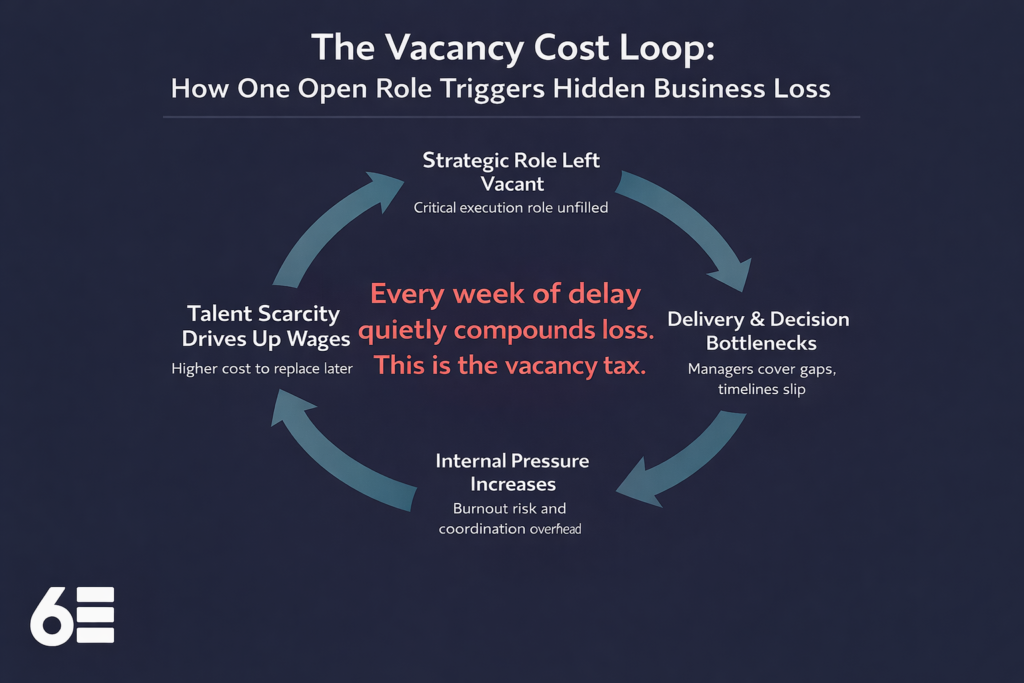

Across the Nordics and Baltics, the cost of vacant senior roles is often underestimated. Many companies treat them as temporary savings. A salary line delayed, not lost. But this is a dangerous illusion.

But the real impact of leaving a strategic role vacant is both hidden and compounding. This article outlines the business case for faster, more targeted hiring, grounded in hard data and designed for CFOs, COOs, and HR leaders driving execution.

The Competitiveness Trap

According to the 2025 PwC Baltic Human Capital & Work Environment Survey and Figure Baltic Advisory, the region is facing a reinforcing risk loop: scarcity of senior talent drives wage inflation, while productivity gains lag behind.

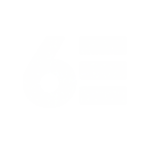

This is how the trap plays out:

- Estonia: 22% of employers name labour cost growth as their top concern

- Latvia and Lithuania: 17% of employers cite talent scarcity as their main growth constraint

- Eurostat data confirms the hardest-hit roles are senior and professional positions, with time-to-fill exceeding 90 days

When a critical role like Product Manager or Head of IT sits open, the business absorbs cost in multiple ways:

- Decision-making slows

- Execution stalls

- Managers shift focus to cover gaps

- Adjacent teams lose coordination and momentum

This is the vacancy tax: the cost of business not done. It accumulates silently, week by week, and rarely shows up in standard hiring metrics.

What It’s Costing You Every Day

Leaving a role open doesn’t save money, it redirects cost into lost output.

| Role | Location | Daily Salary Cost¹ | Estimated Daily Value² | Daily Cost of Vacancy³ |

|---|---|---|---|---|

| Senior Project Manager | Estonia | €386 | €2,000 | €1,614 |

| Product Manager | Latvia | €356 | €2,000 | €1,644 |

¹ Salary based on €75,000 annual gross (Figure Baltic Advisory, 2024; Palgad.ee, 2025)

² Using revenue-per-employee benchmarks (DISCHER, BuiltIn)

³ Value not produced minus salary not paid

These numbers highlight the true cost of vacant senior roles, especially in roles that drive strategy, delivery, and growth.

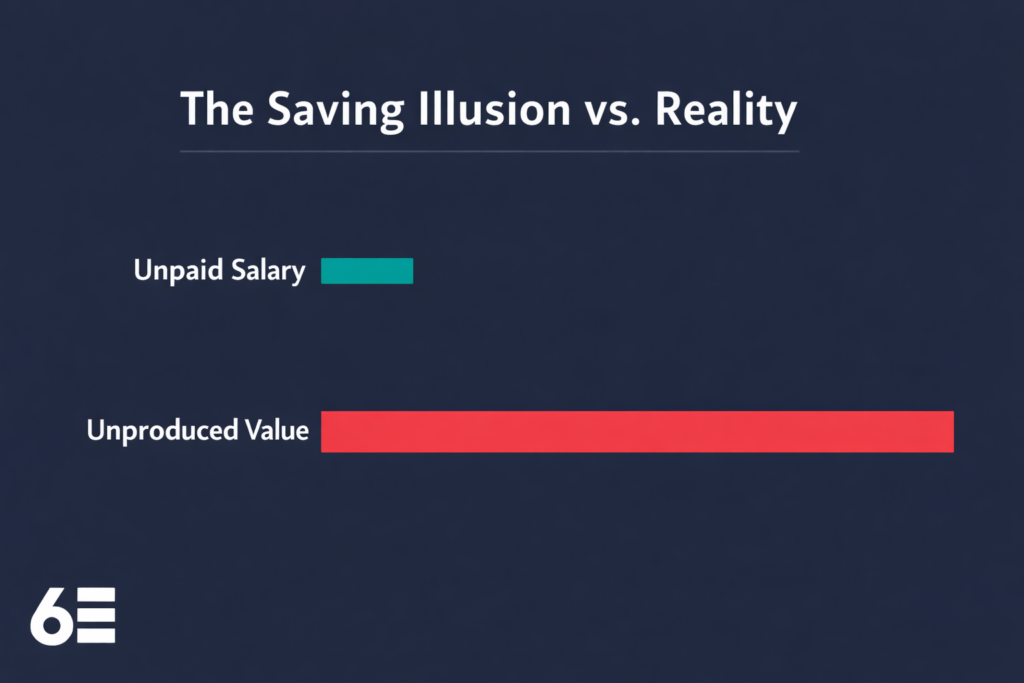

The Longer the Delay, the Higher the Loss

An eight-week delay (40 business days) leads to over €65,000 in lost enterprise value per role.

These are only the base loss figures. They do not include:

- Contractor premiums (40–80% more than salary)

- Coordination drag across departments

- Liquidated damages on delayed project delivery (e.g., 0.1%/day in IT contracts)

- Burnout risk increase especially in lean teams.

These effects are often misclassified as project risk, productivity issues, or team strain. But in most cases, they start with a role that was left open too long.

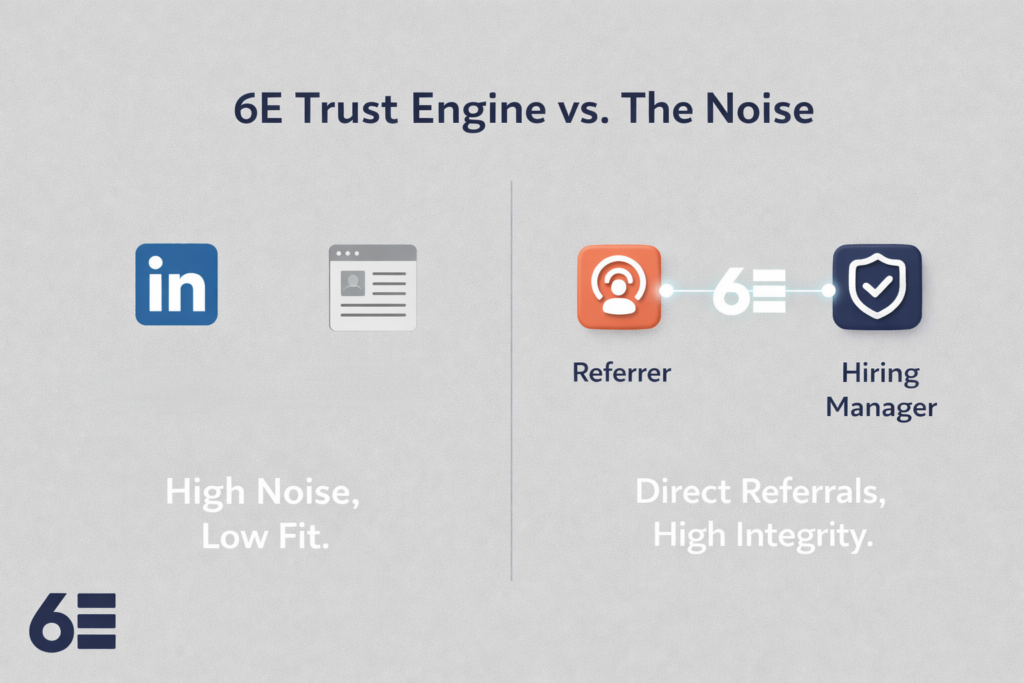

Why Common Hiring Channels Are Too Slow

Most organizations still rely on:

- Job boards

- LinkedIn posts

- Recruitment agencies

- Paid social media campaigns

And it works for entry-level jobs and roles. But not when you recruit senior specialists and leadership roles – senior PMs, product managers, IT architects, Growth Hacker, Brand strategist, etc. generic resumes do not illustrate how the candidates held their ground when the pressure was on. Kept a team focused. Pushed back without burning bridges. Protected the work, the brand, the values, when it mattered most.

Or how they navigated tough clients, delivering when the stakes were high, or lead with integrity even when no one was watching.

Key challenges:

- Passive candidates don’t apply to open ads

- Time-to-fill stretches to 90–120+ days for senior roles

- Agencies deliver generic candidates and reuse the same pools.

Structural Shortages Are Not Going Away

Data from 2024–2025 confirms that talent scarcity is here to stay:

- Sales, Marketing & Development Managers recorded the highest EU job vacancy rate at 8.4%

- Latvia: Highest Baltic JVR overall at 2.5%, with public sector at ~8.0%

- Estonia: Annual shortfall of 1,400 high-skill IT and engineering professionals

- Lithuania: 30.4% of all job openings by 2035 expected to be professional roles, mostly to replace, not grow.

Where 6E Fits In

6E was designed to reduce time-to-fill on roles where delay is already expensive.

By accelerating the hire by just 2-4 weeks, companies in the Baltics see immediate bottom-line recovery, +€ 28,000 in Revenue Protected for Product/Growth Roles and 15% Churn Risk Reduction (Team Morale Benefit).

We do this by:

- Activating passive candidates through a trusted, invite-only referral network

- Avoiding job boards, scraping, or spam

- Ensuring anonymity and consent, no cold outreach

- Reducing noise at the top of the funnel and accelerating decisions

We’re not here to replace your team. We’re the quality source when your internal network has gone quiet.

Summary for Business Leaders

- Strategic roles left open can cost upwards of €1,600 per day in lost productivity and delivery value

- Just 4 to 8 weeks of delay can mean over €60,000 in unrealized business outcomes

- Relying solely on inbound hiring is not a low-risk approach. It’s a high-cost gamble

- A trusted referral channel reduces hiring time, protects timelines, and limits revenue loss

If your organization is not actively addressing the cost of vacant senior roles, you are absorbing that cost whether it is visible or not.

Any role left open for more than 45 days is no longer a delay. It is a risk. Each week compounds the impact: project momentum slows, internal pressure grows, and competitive opportunities slip away.

Take Action Now!

Don’t wait for better inbound. Let us help you reduce cost of delay. Without the noise, drama, or guesswork.

Visit 6E → Click Contact 6E → Find your next critical hire through someone who already knows they’re ready.

Sources

- Figure Baltic Advisory (2024) – Salary benchmarks

- Palgad.ee (2025) – Salary data for IT and product roles

- PwC Baltic Human Capital Survey (2025) – Labour cost and scarcity concerns

- Eurostat OJA (2024) – Online job vacancy data by role type

- CSB Latvia (Q3 2024) – Job vacancy rates

- OSKA / Statistics Estonia – IT and engineering specialist shortfall

- Cedefop Skills Forecast (2022–2035) – Labour replacement trends

- DISCHER / BuiltIn – Cost-of-vacancy benchmarks

- OutstaffYourTeam (2025) – Recruitment fee benchmarks

- iSmartRecruit / Genius (2025) – Global time-to-fill averages